News Details

Position:

Home>

News Details

Making the Case for Composites Recycling

Category: News

Date: 2018-03-10

Click: 1685

Author:

Collection:

Establishing a Recycling InfrastructureBuilding a viable composites recycling system from scratch is a complex process, because many different things have to occur within the same general time frame.

Establishing a Recycling Infrastructure

Building a viable composites recycling system from scratch is a complex process, because many different things have to occur within the same general time frame. First, companies have to solve the technical challenges of extracting the different types of fibers during the recycling process. To date, they’ve made more progress with carbon fibers than with glass fibers due to the relatively high value of recovered carbon fibers.

Then, to reach the operational scale required for commercially viable operations, companies will have to identify a consistent source of composite scrap material. They may have to adapt the recycling technology according to the type of material they’re recycling – carbon fiber or glass fiber, prepreg scrap, trim waste from a cured composite or cured composite.

“Polymer types are different surrounding glass fiber versus carbon fiber, so the reclaiming process conditions may vary,” observes Soydan Ozcan, senior R&D scientist at Oak Ridge National Laboratories (ORNL) and IACMI composite recycling lead. The industry will have to determine, among other things, if a single process can reclaim both types of fiber effectively and if different resins and fibers will react differently to the recycling process.

Companies that provide composites scrap for recycling feedstock will have to be prepared to provide a thorough breakdown of their content. That will require the creation of specifications for such materials, says David Wagger, chief scientist/director of environmental management at the ?Institute of Scrap Recycling Industries. The organization has been helping ACMA and its partners assess what’s needed for successful composites recycling.

“There also needs to be a market for the recycled material to go to,” Wagger adds. “You can do all the collection, sorting and processing, but if it doesn’t make it to someone who is actually transforming it into a new material, then recycling doesn’t happen.”

“There also needs to be a market for the recycled material to go to,” Wagger adds. “You can do all the collection, sorting and processing, but if it doesn’t make it to someone who is actually transforming it into a new material, then recycling doesn’t happen.”

Manufacturers of composites and composite parts have to start thinking about recycling from day one. How can dispensable parts and production scrap be harvested, separated out and converted to a product that that can be reprocessed into new material?

Outlook Promising for Carbon Fiber

The composites industry will be more likely to embrace recycling if there’s a good business case for its adoption. “We have a good story to tell on the carbon fiber side,” says Coughlin. “People are recovering carbon fiber, they are selling it, and it is getting used to the point where there is market pull from major OEMs who see recycled carbon fiber as an attractive resource.” Turning composites scrap from a waste material into a valued resource is a significant milestone in the progress that industry has made just in the last few years.

ELG Carbon Fibre has spent seven years working on a pyrolysis (high-temperature decomposition) process to recover the carbon fiber from composites, and it’s ready to operate on an industrial scale, according to Alasdair Gledhill, ELG’s commercial director. “Now the challenge is to commercialize recycled carbon fiber products,” he says. “We are at a point where ELG is in a position to put together a tailor-engineered, specification-grade raw material for use in many different markets.”

ELG’s primary target is the automotive industry, but there are many different applications and markets in which recycled carbon fibers could be used, including other parts of the transportation industry. “Perhaps we will see recycled carbon fiber making some inroads into the aerospace market for non-mission-critical, non-structural components that require light weighting and high strength,” Gledhill adds.

ELG’s primary target is the automotive industry, but there are many different applications and markets in which recycled carbon fibers could be used, including other parts of the transportation industry. “Perhaps we will see recycled carbon fiber making some inroads into the aerospace market for non-mission-critical, non-structural components that require light weighting and high strength,” Gledhill adds.

ELG uses industrial scrap, cured and uncured prepregs and laminates for its feedstock, most coming from aerospace industrial scrap. “As the business matures, maybe 15 to 20 years from now, we will start seeing more end-of-life scrap come back to us,” Gledhill says. For example, when an automobile is shredded at the end of its lifespan, companies like ELG can capture its carbon fiber components and recycle them. Wind turbine blades could be another source of carbon fiber, even though they contain more glass fiber than carbon.

Gledhill says ELG has the capability of scaling production to meet demand, and the company has set a goal of tripling its capacity in carbon fiber recycling within three years. “Our goal is to make recycled fiber an integral part of the supply chain,” says Gledhill. “We see recycled carbon fiber as being complementary to the growth of primary carbon fibers. In many ways, recycled carbon fiber helps to fill in the supply deficit, which is already forecast for primary carbon fiber.”

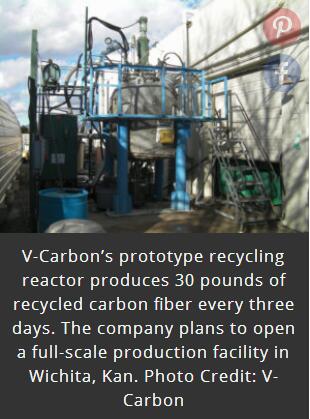

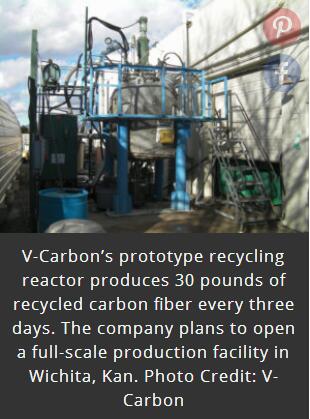

V-Carbon, co-founded by Ron Allred and Damian Cessario, is another company hoping to supply that need. It uses a low-pressure, moderate temperature chemolysis (decomposition using chemical agents) for reclaiming the carbon fiber from composites. It is establishing advanced manufacturing operations in Europe and has a prototype facility in the U.S. that produces about 30 pounds of reclaimed carbon fiber every three days. It will soon open a new plant in Wichita, Kan., that will be able to scale up to meet customers’ needs.

Allred, who serves as head of research and development at V-Carbon, says there is definitely a market for the product. “We have done extensive sampling and prototyping in Europe for the automotive industry and the marine industry for luxury yachts and sporting goods. In Europe, at least, they are very aware that it is coming,” he says. He’s confident that V-Carbon will also get a positive response from customers in the U.S. once the fiber is available in commercial quantities.

V-Carbon plans to vertically integrate its carbon recycling process. “We will generate the recycled fibers, we will process them into non-woven fabrics – both random and aligned – and sometimes make spun yards from them, and then we will have the manufacturing capabilities to produce parts and supply them to the marketplace,” says Allred. “We also have a family of sizings that allows for good translation of properties using the reclaimed fibers. That creates value in every step, and that will make the business profitable.”

The Business Case

Reducing costs is key to the growth of carbon fiber recycling. “Recycled carbon fiber offers a great value for some applications, striking the balance between performance and cost, which is all-important,” says Gledhill.

Recycling has other economic benefits as well. “IACMI estimates that it takes 15 percent of the energy to get the recycled fibers as it does to make the original fiber; that translates into a cost benefit,” says Allred.

Recycling has other economic benefits as well. “IACMI estimates that it takes 15 percent of the energy to get the recycled fibers as it does to make the original fiber; that translates into a cost benefit,” says Allred.

“By recycling carbon fiber waste, you are preserving that entrained energy that is already invested in the primary fiber. That makes economic sense,” says Gledhill. When carbon fiber composite waste goes into a landfill, you lose that entrained energy and have downstream environmental costs.

Reclaimed carbon fibers retain most of their mechanical properties. After pyrolysis, carbon fibers show only a four percent reduction in tensile strength and a two percent reduction in tensile modulus, according to Gledhill.

But recycled carbon fibers differ in one significant way from virgin carbon fibers; the reclaimed fibers are short and discontinuous, rather than continuous. That limits their use in some applications.

“But it also opens up a whole new world of different products that can use short fiber,” says Gledhill. “For example, ELG takes our short fiber and runs it through a carding line [which aligns the fibers] to make a non-woven mat. That is a completely new product that is being brought to market, and that non-woven mat can be substituted in some cases for primary prepreg material or sheet molding compound, which are made from primary fiber.”

“But it also opens up a whole new world of different products that can use short fiber,” says Gledhill. “For example, ELG takes our short fiber and runs it through a carding line [which aligns the fibers] to make a non-woven mat. That is a completely new product that is being brought to market, and that non-woven mat can be substituted in some cases for primary prepreg material or sheet molding compound, which are made from primary fiber.”

Allred says one way to improve the usefulness of reclaimed carbon fiber would be finding a way to align the short carbon fibers. “That would produce a volume fraction up around 50 percent, essentially doubling your mechanical properties,” he adds.

Developing new manufacturing methods could lead to the creation of new, high-value-added products that incorporate these reclaimed fibers, says Ozcan. One IACMI project team is currently working to develop a process and the necessary equipment to align these recycled short carbon fibers. For another project, IACMI is working with BASF, ORNL and the University of Tennessee, Knoxville, to develop high-volume, high-speed processing and material technologies that use short carbon fibers to produce automotive body panels with a Class A surface appearance and the necessary mechanical properties.

Glass Fiber Challenges

Carbon fiber recycling is paving the way to explore fiber recovery technologies that may benefit glass fibers in the future. There have been several attempts made at glass fiber recycling, but it’s met with less success than carbon fiber recycling because of the business model needed to support a fiber recovery program. There is a much greater need, however, as more than 90 percent of the world’s composites are made with glass fibers.

The cement kiln process is one technology currently used for glass fiber recycling. That captures some of the material’s entrained energy, and the reclaimed glass fiber is used primarily for low-value cement filler. That’s better than sending the composite to a landfill but doesn’t provide the best economic incentives for recycling. Pyrolysis is another technology option, but previous attempts have not provided the right combination of recovered fiber strength and value.

Looking for a better solution, ACMA and Owens Corning, under the auspices of IACMI, are leading a collaboration of 12 industry and research partners in the development of a thermal composite recycling technology known as the Thermolyzer?. It is a controlled pyrolysis unit that uses the energy inherent in the composites to fuel the recycling process while preserving the structural value of both glass fiber and carbon fiber. Excess energy generated by the process might even help run other equipment in a factory or laboratory where the Thermolyzer is located.

Looking for a better solution, ACMA and Owens Corning, under the auspices of IACMI, are leading a collaboration of 12 industry and research partners in the development of a thermal composite recycling technology known as the Thermolyzer?. It is a controlled pyrolysis unit that uses the energy inherent in the composites to fuel the recycling process while preserving the structural value of both glass fiber and carbon fiber. Excess energy generated by the process might even help run other equipment in a factory or laboratory where the Thermolyzer is located.

The ACMA-led team will be using a Thermolyzer test unit located in Germany during a trial in March. It plans to recycle a variety of shredded composite materials – wind turbines, industrial scrap and automotive SMC – that contain both carbon and glass fibers.

“[For glass composite recycling] we have to look at pulling out fiber that has a length of greater than ?-inch so that it retains its strength and is not embrittled – it’s usable,” says Dave Hartman, scientific advisor, composites at Owens Corning.

“Once we have figured out how to get the fibers out economically, we are still going to need to develop applications using the recovered glass fiber,” Coughlin adds. The goal is to reach a commercially acceptable level of fiber strength suitable for reinforcement.

Since a continuous process runs most efficiently when it is operating 24/7, the composites industry could work with other industries, such as carpeting and electronics, which also have waste streams that need recycling. This would supply the equipment with the steady fuel stock it requires.

The project team will complete is work by December. While recycling GFRP won’t be easy, Coughlin believes the composites industry will find an answer. He cites the example of paper companies, which had to find ways to make the recycling of low-cost cellulose fiber work. The key was creating a market pull for the recycled products. The federal government helped when it specified the purchase of recycled paper. Commercial companies soon followed, creating demand for fiber recovery. The composites industry and their customers could create that same kind of market pull if they can develop the right applications for recycled glass and carbon fibers.

As the technologies improve and new markets open for both recycled glass and recycled carbon fibers, the supply of both will increase to meet the demand. There is a lot of opportunity for growth of recovered fibers: Among the approximately 100,000 tons of primary carbon fiber produced each year, about 30,000 tons become scrap in the production process and only about 10 percent of that is currently recycled.

As the technologies improve and new markets open for both recycled glass and recycled carbon fibers, the supply of both will increase to meet the demand. There is a lot of opportunity for growth of recovered fibers: Among the approximately 100,000 tons of primary carbon fiber produced each year, about 30,000 tons become scrap in the production process and only about 10 percent of that is currently recycled.

“There’s still a long way to go to make sure that the 30,000 tons of carbon fiber scrap is handled responsibly and sustainably and recycled,” Gledhill says. “I think it will become self-evident that when you have a waste stream that has inherent value, there are economic incentives to keep it out of a hole in the ground.” In Europe, at least, there are also regulations to prevent landfilling.

“Those two things will come together and drive the development of more recycling capacity,” Gledhill says.

“Industry interest in composite recycling used to be low, but that has changed,” Ozcan adds. “People are excited about it. The more that they hear from us, they more they want to be involved. They understand the importance and the possibilities.”

A Global Concern

The worldwide composite industry needs to develop better, cost-effective technologies for recycling composite materials. European composites and parts manufacturers in particular are facing stringent regulatory mandates because of the lack of landfill space. They must recycle virtually all their waste and/or their composite products at end of life.To spur international cooperation, ACMA has taken a leadership role in establishing the Global Composites Recycling Coalition. It includes six trade associations, five labs/universities and 25 companies with representation from Europe, Asia, North America, Africa and Australia. “We have been promoting the idea of cooperating and disseminating technology,” says Dan Coughlin, ACMA’s vice president of composites market development.

The group met in 2016 and 2017 and plans another meeting this year. Participants have discussed topics such as recycling technologies and strategies, standards developments for recycled fibers and parts, promoting market pull for recycled composite products and overcoming barriers to composites recycling.

ACMA will also bring together experts from around the world for its first-ever Composites Recycling Conference, scheduled for April 10-12 in Knoxville, Tenn. For more information, visit www.acmanet.org/recycling.

Say something

Submit

Latest comment